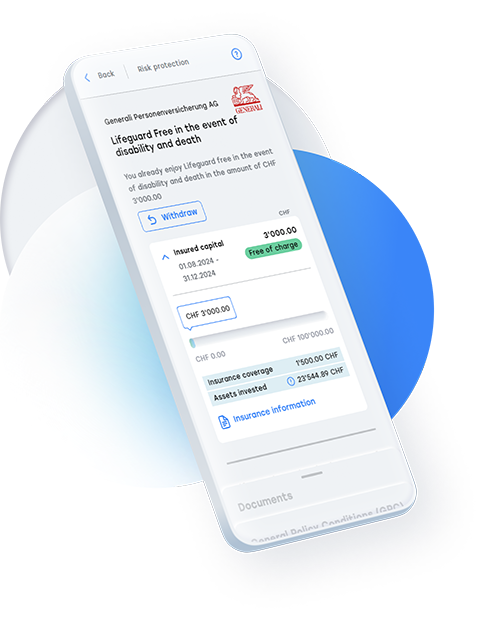

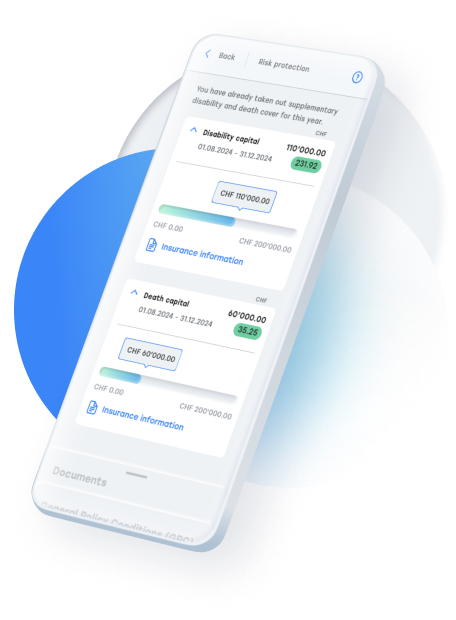

In case of disability or death**, you or your heirs will receive an additional lump sum benefit of up to 2,500*** Swiss francs per 10,000 Swiss francs invested. The free insurance coverage will be automatically activated as soon as you have invested 10,000 Swiss francs or more in securities in your pillar 3a or vested benefits account on eplix.

Benefit from our extensive network and additional services, including the free insurance coverage developed in partnership with our insurance partner, Generali.

*Foreign nationals require a Swiss residence permit of category B, C, Ci, or G to obtain the eplix Lifeguard Free insurance.

**Due to illness or accident

***The insured capital amount varies based on the insured’s age. Insured individuals aged 18-34 receive coverage of 2,500 Swiss francs per 10,000 Swiss francs invested.